I posted recently that student loan delinquency rates have climbed to 18%. But with new data just released, the real picture looks much worse.

Tag Archives: student loans

Shock Poll: 27% of Student Loans in Default

We knew it was bad, but now it looks even worse than we thought. Twenty-seven percent of student loan borrowers are a month behind on their loan payments. Keep in mind, this debt cannot be discharged in bankruptcy; these borrowers are stuck with it no matter what.

…if we adjust the delinquency rate to consider that only a fraction of the borrowers have payments due, this level of delinquency is very concerning: A delinquency rate of 15 percent for all student loan borrowers implies a delinquency rate of 27.3 percent for borrowers with loans in repayment. This level of delinquency is much higher than for any other type of debt (credit cards, auto loans, mortgages, and so on).

3 People with Massive Student Loan Debt

Here’s another personal interest story from CNN Money. It tells the sad, yet familiar story of 3 people in their 20s who have a ton of student loan debt ($56k-$114k).

What’s most telling is that there is no mention of what kind of degrees they hold. Finance? Communications? Trans-alpine paragliding? What?

Not all college degrees are created equal.

Americans Saving Up Record Amount for College

From CNN Money:

They amount of money in the savings plans grew to a record $248 billion in 2014, about 9% more than the previous year.

People are starting to save for their children earlier than ever. About 31% of the savings plans are opened by parents when their child is barely a year old, or before, according to the College Savings Plans Network.

Given the poor quality of most people’s saving habits, this is worth celebrating. Although, I do question how good of an investment a college degree is for many people.

There has been talk recently about doing away with tax-beneficial 529 Plans. The government wants all the money it can get. I’d say this is more likely to happen than doing away with IRAs or 401(k)s, but still pretty unlikely, especially in light of how many people are taking advantage of them.

If you have kids, a 529 savings plan (NOT pre-paid tuition) is a good option for saving up for college. Money is about possibilities, so even though college isn’t right for everyone, you want to have the possibility to buy it for your kids should they so choose. And without saddling them with student loan debt they’ll never be free from.

Credit Tightens, But Not by Much

Credit numbers are out for the last quarter of 2014. Here are the highlights from ZeroHedge:

Housing Debt

- Originations, which we measure as appearances of new mortgage balances on consumer credit reports and which includes refinanced mortgages, increased slightly, to $355 billion, but remain low by historical standards.

- About 122,000 individuals had a new foreclosure notation added to their credit reports between October 1 and December 31.

- Mortgage delinquencies improved, with the share of mortgage balances 90 or more days delinquent decreasing slightly; 3.1% of mortgage balances were 90+ days delinquent during 2014Q4, compared to 3.2% in the previous quarter.

Student Loans, Credit Cards, and Auto Loans

- Outstanding student loan balances reported on credit reports increased to $1.16 trillion (+$31 billion) as of December 31, 2014, representing about $77 billion increase from one year ago.

And the kicker:

- Student loan delinquency rates worsened in the 4th quarter. About 11.3% of aggregate student loan debt is 90+ days delinquent or in default in 2014Q4, up from 11.1% in the third quarter.

- Auto loan delinquency rates worsened. The 90+ days delinquency rate is now at 3.5%, up from 3.1% in the previous quarter.

That’s a lot of deliquency. Nearly 1/8 of all student loan debt is 90+ days late. And that debt doesn’t go away.

Revolving Credit Surges; Auto and Student Loans Slow

The most notable aspect was the $5.77 billion surge in revolving credit (e.g. credit cards) as Americans extended and pretended into the holidays – the biggest rise since April, and the second biggest monthly increase since the GFC…student and auto loans rose by the smallest amount since February 2012!

So student loans and auto loans are still increasing; they’re just growing at a slower rate.

I suspect this has something to do with the fact that so many loans have been made, they are reaching the saturation point. With student loan debt at all-time highs, there isn’t much room for more growth.

Still, lending standards are loose. If you have good financial habits and low debt, now is a great time to get a loan and move up the credit ladder.

Case Study: How to Do Absolutely Everything Wrong with Your Money

If you set out to do the EXACT OPPOSITE of what these people did, you’d be in good shape.

A decade ago, Comfort and Kofi were at the apex of an astonishing journey they had made from Ghana in 1997, when they had won a visa lottery to come to America. They did not know it at the time, but they were also at the midpoint in their odyssey from American Dream to American Nightmare.

Today, they struggle under nearly $1 million in debt that they will never be able to repay on the 3,292-square-foot, six-bedroom, red-brick Colonial they bought for $617,055 in 2005. The Boatengs have not made a mortgage payment in 2,322 days — more than six years — according to their most recent mortgage statement. Their plight illustrates how some of the people swallowed up by the easy credit era of the previous decade have yet to reemerge years later.

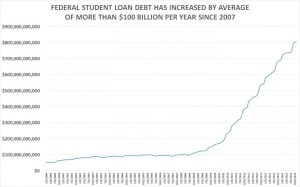

Federal Student Debt Now over $800,000,000,000

From November 2013 through November 2014, the aggregate balance in the federal direct student loan program–as reported by the Monthly Treasury Statement–rose from $687,149,000,000 to $806,561,000,000, a one-year jump of $119,412,000,000.

The balance on all student loans, including those from private sources, exceeded a trillion dollars as of the end of the third quarter, according to the Federal Reserve Bank of New York.

This is federally-owned debt; total student loan debt is roughly $1.3 trillion. Think this may be a bubble? Smart money says yes.

College Students Completely in the Dark About Student Loan Debt

Ever wonder how the student loan debt bubble got to $1.2 trillion? It’s because college students have absolutely no idea how much debt they’re racking up.

From a report by the Brookings Institute:

- Only a bare majority of respondents (52 percent) at a selective public university were able to correctly identify (within a $5,000 range) what they paid for their first year of college. The remaining students underestimate (25 percent), overestimate (17 percent), or say they don’t know (seven percent).

- About half of all first-year students in the U.S. (based on nationally representative data) seriously underestimate how much student debt they have, and less than one-third provide an accurate estimate within a reasonable margin of error. The remaining quarter of students overestimate their level of federal debt.

- Among all first-year students with federal loans, 28 percent reported having no federal debt and 14 percent said they didn’t have any student debt at all.

Average Student Loan Debt: $28K

The College Board has released its annual reports on tuition costs and financial aid.

The punch line: students who graduated in 2013 with student loan debt had an average total of $28,400.

For most of them, this is bad. Many degrees are worthless even in a better economy and a better job market than we have right now.

The few who graduated with degrees in skilled fields like computer science and engineering will probably be fine. Other degrees, probably not. Note that this isn’t just the obvious silly majors like Etruscan Pottery or Shemale Lacrosse, but some generic business degrees as will.

College isn’t what it used to be, but most people are slow to catch on to that.