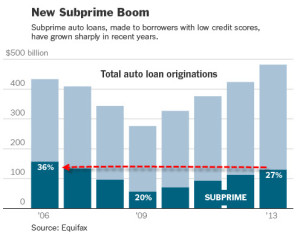

Much of the economic “growth” over the past few years has been a result of subprime auto loans boosting car companies’ profits. And the trend has gone on so long some car dealers are starting to worry.

From CNBC:

Consumer confidence is perhaps the best indicator of why auto sales are running so strong. For years, it’s been clear that as consumer confidence goes, so go auto sales. The most recent reading has consumer confidence at its highest level since 2004. Not surprisingly, auto sales this year are expected by many to reach or exceed 17 million vehicles for the first time since 2001. Last year, U.S. auto sales totaled 16.52 million vehicles…”Nothing is typical with this cycle. We’re all holding our breath wondering how far this can go,” said Krebs. She pointed out that the possibility of higher interest rates later this year and an impending surge of used cars that will hit the market once they reach three or four years in age could both slow down new car sales.

Yes, interest rates will have to go up eventually. So if you have the means and have developed the good financial habits necessary to handle a car loan, then now is the perfect time to step up the credit ladder and get a car.

If you’re not going to need a new car in the next couple of years, don’t get one. It’s not worth it just to get that loan reporting on your credit scores.

But also keep in mind that we’re at a historically unprecedented interest rate level right now. Rates won’t be this low for a very long time, so if you’re planning to buy a car in the next year to 18 months, you might consider pulling the trigger, as long as you can afford the payments based on your current income.

This is a good time for smart people with good financial discipline to take advantage of low interest rates and profit.